The Correlation Between Crypto, Gold and S&P500

In brief:

- Historical comparison between Bitcoin and Gold.

- Understanding how these assets correlate.

- Slow process of Bitcoins social acceptance.

- Lack of a regulated crypto news cycle.

Ever since the mainstream media started talking about Bitcoin back in 2017, the primary metaphor used to begin scratching the surface of understanding what Bitcoin is, was to say that it is something of a digital Gold.

Now when it comes to the discussion of what’s the best store of value, in the world of traditional finance, nothing beats the safety of Gold.

With that comparison in mind, the crypto and legacy markets are increasing their levels of correlation. The new asset class has been trading like a big tech stock for a while as the global markets begin to embrace Bitcoin as its own.

The record correlation we observed between Bitcoin and Gold in 2020 indicates investors don’t see a difference between the two anymore, as they behave the same and serve the same purpose as stores of value.

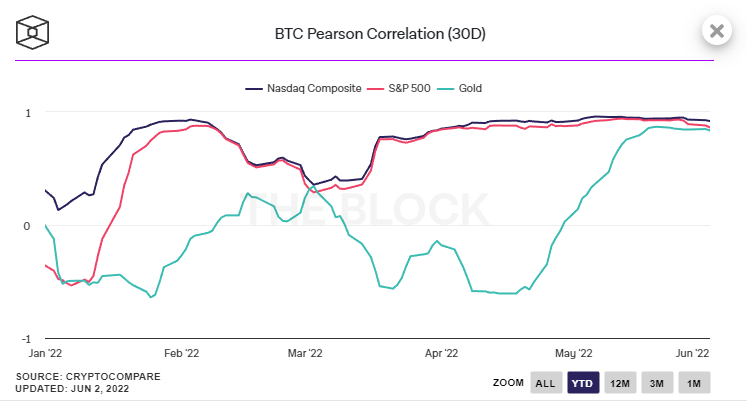

But that correlation seems to be experiencing a shift in 2022, with a new player replacing Gold for the highest positive correlation.

Understanding Pearson Correlation Values and its Importance

When examining the correlation between two assets, you’re attempting to measure the strength and direction of the relationship between them. The correlation between two assets is 0 if there is no relationship at all. Similarly, a correlation of 1 means a perfect positive relationship between the two assets.

This correlation can also go into the negative values, implying that every move of a source asset is met with the opposite on the target asset in the comparison.

Correlation does not imply causation, meaning there doesn’t necessarily have to be a cause-and-effect relationship. Still, it does suggest there is some link between the two assets we are observing.

Without any fancy tools or charts, let’s check for ourselves what’s the YTD performance of the following assets.

YTD Performance, 02.06.2022:

– BTC down -36%

– NQ down -24%

– S&P500 down -13%

– Gold up 5%

A simple observation already gives us a base to work with.

Ever since BTC hit its ATH price and coincidentally matched the price of 1kg of Gold, this trend of a positive correlation with Gold has ended. So far in 2022, the correlation between Gold and Bitcoin has been negative, while the correlation between Bitcoin and S&P500 has hit values as close to 1 for a strong 6 months now with no end in sight.

You can see from the picture above Gold has mostly correlated with Bitcoin in a negative way, meaning for most moves Gold made, Bitcoin has done the opposite. It’s interesting to point out how strongly S&P500 and NQ are correlated with Bitcoin.

The correlation Between BTC and legacy markets is almost a steady 1, an impressive average of 0.87 for the whole year so far.

Is there a reason how this correlation came about?

SP500 is the leading indicator of how well America’s top companies are performing. The valuation of the markets is impacted by many things, including economic trends and geopolitics.

The increased correlation between Bitcoin and S&P500 is an indicator of a trend we have been observing this year. That trend being the acceptance of Bitcoin as an actual store of value, not just the speculation of value.

Since 2017 you might have heard the phrase ‘Institutional Money’ now while it is true VCs have been dipping their toes in a crypto way before your neighbor started shilling you XRP, it has only this year become the norm for every single investor out there to look into having Bitcoin in his portfolio along with other Altcoins.

This was definitely not the case before, as this trend has mainly been pushed just recently. The most notable influencer in this trend being Michael Saylor.

Saylor’s MicroStrategy owns more than 129,000 BTC, with no intention of selling anytime soon.

I didn’t buy it to sell it. Ever.MicroStrategy’s Michael Saylor

Nowadays, no single bank or institution doesn’t have at least 2% of its holdings in crypto or Bitcoin. And as a sober reminder, a year ago, this was not the case.

We like to say one year in crypto is three in traditional finance. We also like to say ‘Follow the trend.’, so it should be logical to expect these numbers to increase soon.

These points may be one of the reasons we see such a deep correlation between S&P500, but there is another one that we haven’t seen mentioned anywhere.

The news cycle that crypto lacks and what it means for you

Anyone who trades Forex or Stocks knows there’s a clear and distinct news cycle. The Forex market runs during regular business hours in four different parts of the world and their respective time zones.

This is a world of difference from crypto, where the markets are open 24/7 and do not close during the weekends.

The Forex market has a distinct cycle during the week. If you are skilled enough, you will observe how accumulation, distribution, and all price actions are timed with the events of that week. Be that FOMC, GDP report, unemployment rate, NFP, retail sales, etc.…

Compared to crypto, where there is no such regulation, the news cycle is non-existent or seemingly random. The only news that can impact crypto are geopolitical events or black swan events like the recent LUNA crash.

For this exact reason, it’s only natural for crypto as a whole to attach itself to the news cycle of another market. Now that Bitcoin correlates so heavily with S&P500, you could essentially trade the same moves on both markets.

What this means for the future of crypto

With Bitcoin being seen more and more as an actual store of value, it’s only natural a part of its adoption will be accelerated by being absorbed into legacy markets.

It’s also worth noting that many crypto investors like to be scared of any regulation that’s pushed onto crypto. We want to think crypto will never be fully regulated, and it simply moves too fast. Crypto is its beast. But it is important to note Bitcoin will be the main playground for any regulation crypto gets.

Due to the cryptos nature of decentralization, there will be areas where regulation might never even reach.

These reasons make Bitcoin the perfect middle-ground between legacy and native crypto markets. But this isn’t to say Bitcoin will break away from crypto, and it will simply act as the glue between the worlds. As a result, it is further driving adoption.